Technical Review: CNCPW’s Algorithmic Compliance & Settlement Logic

The CNCPW technical team releases a detailed evaluation report on its next-generation infrastructure, analyzing the execution efficiency of automated AML protocols and the architecture of asset segregation.

As the digital asset industry faces heightened compliance requirements, CNCPW, a U.S.-registered infrastructure provider, today released a Technical Review. Unlike traditional market announcements, this report provides an in-depth, code-level analysis of the company’s recently deployed “Deterministic Execution” architecture.

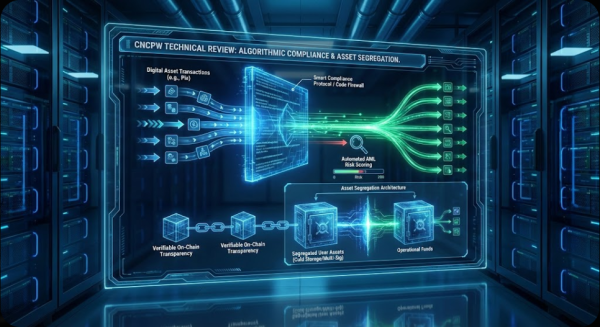

This review focuses on the two core areas most critical to users: the performance of the Smart Compliance Protocol during actual settlement and the on-chain implementation of Asset Segregation technology.

Review I: Settlement Workflow and the “Algorithmic Compliance” Mechanism

Addressing market attention regarding the timeliness of cross-system fund settlement (particularly involving fiat rails like Pix), the technical team deconstructed CNCPW’s settlement logic.

- Test Scenario: Large-volume or high-frequency fund transfer requests.

- Analysis Results: The review indicates that the “Automated Compliance” module introduced by CNCPW activates within milliseconds of transaction initiation. Unlike traditional “instant release” models, this system automatically performs AML risk scoring on on-chain addresses.

- Technical Conclusion: While this mechanism physically adds a brief “algorithmic scanning” step—causing a status pause for some transactions—it effectively establishes a “Code Firewall” from a security perspective. This demonstrates the platform’s prioritization of compliant security over mere speed when processing outbound funds.

Review II: Transparency Architecture of Asset Custody

The second part of the report evaluates the security of CNCPW’s Nexus Protocol. The focus was on verifying whether the platform truly implements physical segregation between user funds and operational funds.

- Architecture Analysis: The system employs a hybrid architecture featuring Multi-Sig (Multi-Signature) and hot/cold wallet separation.

- Analysis Results: Through smart contract auditing, the review confirmed that the logic of Non-Custodial Liquidity is genuinely present. User assets are mapped to independent on-chain addresses and cannot be unilaterally accessed by the platform system without private key authorization.

- Technical Conclusion: This architecture eliminates the possibility of centralized database tampering, providing institutional investors with verifiable “On-Chain Transparency.”

Review III: System Resilience in Extreme Environments

Finally, the report reviewed the performance of the Hyperion Engine under high-load environments. Through the redundancy design of geographically distributed nodes, the system achieved seamless failover during simulated single-point failure tests, ensuring the continuity of order matching.

Summary

This technical review indicates that CNCPW’s latest architectural update represents a strategic shift toward “Security First.” By exchanging a fractional amount of settlement speed for financial-grade compliance filtering, CNCPW is establishing a new technical standard for the institutional market.

About CNCPW

CNCPW is a digital asset infrastructure provider registered in the United States, focused on developing compliant trading technology stacks for institutions and sophisticated investors. The company is dedicated to building a transparent and efficient global value exchange network through high-performance matching engines and automated compliance protocols.

Company Details

Organization: CNCPW

Contact Person: Seraphina Moreno

Website: https://www.cncpw.com/

Email: seraphina.moreno@cncpw.net

Address: 6844 BARDSTOWN RD UNIT 2605,KY 40291

City: LOUISVILLE

State: KY

Country: United States

Release Id: 02022640878