IPSE Navigates Legal Challenges to Build a Secure Market for IP Securities

IPSE addresses the challenges of securitizing intellectual property by ensuring compliance with legal frameworks and creating a transparent, secure market for IP-backed securities. The company is committed to regulatory efforts to foster trust in this emerging asset class.

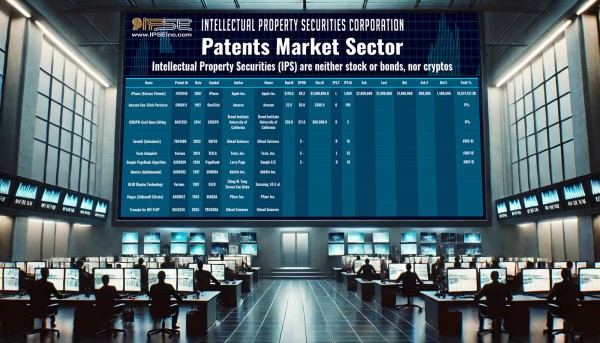

United States, 30th May 2025 – The intellectual property (IP) sector is rapidly evolving, with an increasing number of innovators and creators looking for ways to monetize their intangible assets. However, the process of securitizing intellectual property—transforming patents, copyrights, trademarks, and trade secrets into tradeable securities—has posed significant challenges. As a leader in this innovative field, the Intellectual Property Securities Exchange (IPSE) has been addressing these hurdles by working closely with legal and regulatory bodies to ensure that the Intellectual Property Rights Offering (IPRO) complies with existing laws and is adaptable to emerging regulations.

This work is central to IPSE’s mission to establish a transparent and secure market for intellectual property-backed securities, a critical step towards revolutionizing how IP assets are traded.

Legal Complexity in Securitizing Intellectual Property

One of the core challenges facing IPSE in the development of IP-backed securities is the inherent complexity of intellectual property law. Unlike physical assets or traditional securities, intellectual property is governed by distinct sets of legal frameworks depending on the type of IP. For example, patents are subject to patent law, while copyrights are protected by copyright law, and trademarks fall under trademark law. Furthermore, trade secrets have their own unique regulations.

Navigating these multiple legal systems and ensuring that each type of IP is handled appropriately in a securitization context is not a simple task. For IPSE, creating a standardized process for securitizing these diverse assets has involved significant coordination with intellectual property experts, attorneys, and regulatory bodies. The company’s aim is to establish a legal framework that can be applied across different types of IP, making it easier for creators to bring their assets to market while ensuring compliance with laws across jurisdictions.

Ownership Challenges in IP Securitization

Unlike traditional securities, the ownership of intellectual property is often not straightforward. IP can be co-owned by multiple parties, licensed to third parties, or subject to complex agreements that make determining ownership rights a challenge. This is in stark contrast to conventional assets, where ownership is typically clear-cut.

In the case of patents, for instance, an individual inventor may share ownership with a corporation or another inventor, complicating the process of securitizing the asset. Similarly, trademarks or copyrights may be subject to licensing agreements that extend to multiple entities or regions. To resolve these challenges, IPSE has developed a robust framework that ensures the ownership rights of intellectual property are clearly defined and verifiable before it is securitized. This framework not only facilitates the securitization process but also safeguards all parties involved by ensuring that the rights to an IP asset are not disputed later in the process.

By offering a clear, transparent method for determining and verifying ownership, IPSE is making it easier for creators and owners to participate in the securitization process, thereby enhancing the market’s credibility.

Building a Liquid and Secure Market for IP Securities

As the market for IP-backed securities grows, the need for liquidity and security becomes paramount. Traditional financial markets, such as stock exchanges, are highly liquid due to the well-established infrastructure and regulatory oversight. For IP-backed securities, however, creating such a liquid market presents unique challenges.

IPSE is committed to ensuring that the process of buying, selling, and trading IP-backed securities is transparent and secure. To achieve this, the company works with regulatory authorities, such as the Securities and Exchange Commission (SEC), to ensure that its offerings meet strict securities laws. Additionally, IPSE is exploring innovative solutions, including blockchain technology, to increase transparency and security within the market, providing a seamless experience for investors and ensuring that transactions are executed without delays or security risks.

By working with both legal and technological experts, IPSE is positioning itself as a leader in the emerging market for intellectual property-backed securities, helping to build a market that is not only transparent and secure but also trustworthy. This is crucial for attracting investors and ensuring that the market continues to grow and thrive.

IPSE’s Legal and Regulatory Compliance Efforts

IPSE’s commitment to compliance with existing securities laws and regulations is central to its strategy of building a secure and trustworthy marketplace for intellectual property-backed securities. The company’s legal team actively engages with policymakers, industry experts, and regulators to ensure that IPSE’s offerings are legally sound and meet the necessary regulatory requirements.

Moreover, IPSE is involved in shaping the future regulatory landscape for IP-backed securities. By participating in discussions with regulators and other stakeholders, IPSE aims to help establish a legal framework that will foster innovation while ensuring investor protection. This proactive approach positions IPSE as not just a market participant but a key player in the development of legal standards for the securitization of intellectual property.

About IPSE

The Intellectual Property Securities Exchange (IPSE) is a pioneering platform that focuses on the creation, issuance, and trading of intellectual property-backed securities. IPSE aims to revolutionize how intellectual property assets are used in global financial markets, providing an avenue for creators, innovators, and investors to unlock the value of intangible assets. By working closely with legal and regulatory bodies, IPSE ensures that its offerings comply with existing laws and that its market remains transparent, secure, and trustworthy.

Media Contact

Intellectual Property Securities Corporation

Media Relations

Email: skender@IPSEcorp.com

Phone: +1 (561) 827 1180

Website: www.IPSEcorp.com

Media Contact

Organization: Intellectual Property Securities Corporation

Contact Person: Intellectual Property Securities Corporation

Website: http://www.ipsecorp.com/

Email: Send Email

Country: United States

Release Id: 30052528491