Insurance Agency Expands Support for Local Communities

American Financial Solutions LLC strengthens communities through education, outreach, local employment, wellness programs, safety training, and environmental initiatives—fostering trust, preparedness, and well-being while providing reliable, community-focused insurance services.

Waterbury, CT, United States, 9th Dec 2025 – An Insurance Agency plays a crucial role in shaping financial security and building stronger communities. Recently, many agencies have shifted their focus beyond providing traditional coverage to expanding their involvement in local development. This renewed commitment includes supporting small businesses, organizing awareness drives, and funding community-based programs that enhance safety and well-being. By connecting with residents and understanding their unique needs, an Insurance Agency demonstrates that protection goes beyond policies—it’s about people. This dedication to local partnerships fosters trust, strengthens relationships, and ensures that every service offered contributes to a more resilient community. Through active engagement and compassionate service, these agencies continue to make a meaningful difference in the places they serve.

Community Outreach Programs

An Insurance Agency increasingly participates in outreach programs designed to address local needs and uplift underrepresented groups. These programs often include safety seminars, financial literacy sessions, and support for community centers. Through consistent interaction with residents, the agency fosters awareness and encourages preventive action against potential risks. Such proactive involvement also helps strengthen the community’s resilience and readiness for unexpected events. The Insurance Agency not only safeguards assets but also nurtures relationships that build a foundation of care, trust, and sustainable growth within neighborhoods.

Educational Initiatives

Education remains a vital component of an Insurance Agency’s mission to empower communities. Many agencies conduct workshops on risk management, emergency preparedness, and responsible planning to help individuals make informed decisions about their future. These sessions are tailored to specific age groups, ensuring accessibility for students, working adults, and retirees alike. By providing valuable knowledge and easy-to-understand resources, the Insurance Agency equips residents with tools to navigate uncertainties confidently, transforming financial protection into a long-term educational partnership that benefits the entire community.

Local Employment Opportunities

An Insurance Agency contributes to community growth by creating stable employment opportunities. By hiring locally, these agencies strengthen economic circulation, empower residents, and foster a sense of pride within the neighborhood. Beyond job creation, they also offer professional training, mentorship, and leadership programs that help employees develop essential skills for career advancement. Each Insurance Agency plays a dual role protecting clients while also building economic resilience. This approach encourages local participation, enhances livelihoods, and promotes sustainable prosperity that benefits individuals and their families.

Sponsorship and Charitable Events

Supporting charitable causes allows an Insurance Agency to connect with communities on a deeper level. Through sponsorships and donations, agencies help fund events such as school drives, health fairs, and disaster relief programs. These acts of generosity demonstrate a genuine commitment to improving quality of life beyond business operations. Each Insurance Agency sees giving back as part of its responsibility, not merely a gesture of goodwill. By contributing resources and time, agencies strengthen their bond with the community while promoting compassion and shared progress.

Environmental Responsibility

Sustainability has become a growing priority for every Insurance Agency aiming to make a lasting impact. Many are integrating eco-friendly practices such as digital documentation, paperless transactions, and support for local environmental campaigns. These efforts not only reduce operational waste but also inspire residents to adopt greener habits. By promoting sustainability, each Insurance Agency takes an active stance in protecting the planet and ensuring a healthier environment for future generations proving that financial protection and ecological responsibility can work hand in hand toward a brighter tomorrow.

Health and Safety Advocacy

An Insurance Agency also prioritizes health and safety advocacy to ensure community well-being. Agencies frequently collaborate with local organizations to host wellness fairs, safety training, and emergency preparedness workshops. These activities promote awareness and equip individuals with the knowledge needed to prevent accidents and manage risks effectively. Through such programs, an Insurance Agency highlights its dedication to holistic care protecting not only material assets but also lives. Their continued focus on safety reinforces their vital role in building strong, well-informed, and secure communities.

Community Wellness Programs

An Insurance Agency actively participates in wellness initiatives to promote public health. These programs often include free health screenings, vaccination drives, and educational workshops on nutrition and mental well-being. By engaging with residents directly, the agency helps individuals adopt healthier lifestyles while fostering awareness about common health risks. These efforts demonstrate the agency’s commitment to community care, showing that protection extends beyond policies to nurturing overall well-being and long-term safety for every neighborhood member.

Safety Training Initiatives

Safety is a top priority for an Insurance Agency, which often organizes workshops on fire safety, first aid, and accident prevention. By teaching residents practical skills and precautionary measures, the agency empowers individuals to respond effectively during emergencies. These training sessions reduce potential hazards and build confidence, reinforcing the community’s preparedness. Through consistent safety education, an Insurance Agency contributes to reducing injuries and creating a secure environment where everyone can thrive with peace of mind.

Emergency Preparedness Workshops

An Insurance Agency hosts emergency preparedness workshops to equip communities with the tools needed for natural disasters or unexpected incidents. These sessions cover evacuation planning, supply management, and communication strategies during crises. Residents gain valuable insights on how to protect their families and property, while the agency strengthens its role as a trusted community partner. By focusing on preparedness, an Insurance Agency ensures that neighborhoods are better equipped to respond to challenges, minimizing risk and promoting resilience.

Collaboration with Local Organizations

Partnering with local organizations allows an Insurance Agency to expand its health and safety advocacy efforts. These collaborations can include schools, community centers, and healthcare providers, creating broader access to workshops and educational programs. By leveraging community networks, the agency ensures initiatives reach diverse groups, addressing specific local needs. Through these partnerships, an Insurance Agency demonstrates its dedication to collective well-being, ensuring that residents receive consistent support in maintaining safety and health throughout the community.

Promoting Long-Term Community Safety

By investing in continuous education, awareness campaigns, and proactive health initiatives, agencies help communities develop habits and practices that prevent accidents and emergencies. These efforts reinforce trust and highlight the agency’s commitment to protecting both lives and property. Through sustained advocacy, an Insurance Agency not only mitigates immediate risks but also fosters a culture of preparedness, resilience, and care that benefits the entire community.

Strengthening Community Partnerships

Collaborations with civic leaders and organizations allow an Insurance Agency to maximize its community impact. By joining forces with educational institutions, local councils, and non-profits, agencies can extend resources where they’re needed most. These partnerships often result in neighborhood improvement projects, public awareness drives, and financial assistance programs. An Insurance Agency that builds strong alliances demonstrates a long-term commitment to social responsibility and collective empowerment, helping local communities thrive through cooperation, shared purpose, and mutual respect that benefits everyone involved.

Conclusion

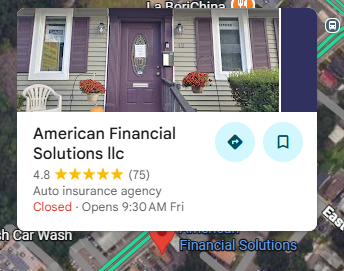

The continued effort of an Insurance Agency to expand its support for local communities highlights the power of partnership and compassion in business. Through education, outreach, and engagement, these agencies strengthen connections and build a sense of trust that extends far beyond policy coverage. Each initiative reflects a genuine commitment to helping people live safer and more secure lives. For reliable coverage and community-focused service, contact American Financial Solutions LLC in Waterbury, CT. Our team is ready to assist with your insurance needs. Call us today at (203) 706-4015 and experience dedicated support you can count on.

American Financial Solutions LLC

48 Meriden Rd Waterbury CT 06705

(203) 706-4015

https://www.americanfinancialsolutions.net/

Company Details

Organization: American Financial Solutions LLC

Contact Person: American Financial Solutions LLC

Website: https://www.americanfinancialsolutions.net/

Email: Send Email

Contact Number: +12037064015

Address: 48 Meriden Rd, Waterbury, CT 06705, United States

City: Waterbury

State: CT

Country: United States

Release Id: 09122538775