Insurance Agency Expands Access to Life and Health Policies

American Financial Solutions LLC in Waterbury, CT expands life and health coverage, offering accessible, flexible policies with personalized guidance, education, and streamlined enrollment to ensure long-term financial and health security.

Waterbury, CT, United States, 28th Nov 2025 – Insurance Agency initiatives are reshaping how individuals and families secure their financial well-being. As communities grow and needs evolve, access to comprehensive life and health coverage becomes increasingly vital. By broadening its services, the Insurance Agency ensures that more people can obtain policies designed to protect their loved ones and safeguard their future. This expansion reflects a commitment to inclusivity, offering tailored options for different income levels and lifestyles. With a focus on transparency and client education, the Insurance Agency empowers clients to make informed decisions about coverage that fits their circumstances. Through this strategic growth, the agency strengthens its role as a trusted partner in promoting long-term financial security and peace of mind.

Expanding Coverage for Every Household

The Insurance Agency is broadening its range of life and health policies to include diverse coverage options that match different household needs. Whether clients seek basic protection or comprehensive plans, the agency tailors solutions to align with financial capacity and lifestyle. By prioritizing accessibility, the Insurance Agency ensures that families can safeguard their income and medical well-being. This expansion is not just about offering more products it’s about delivering peace of mind and empowering individuals to face life’s uncertainties with financial confidence and dependable protection.

Simplifying the Enrollment Process

Through streamlined procedures, the Insurance Agency removes barriers that once made obtaining coverage complex or time-consuming. Clients can now access policies faster through simplified applications, clear communication, and personalized guidance. The agency’s approach ensures that more people can understand their options without feeling overwhelmed by industry jargon or confusing terms. This clarity fosters trust and encourages proactive financial planning.

Streamlined Application Experience

The Insurance Agency introduces a user-friendly application system that minimizes paperwork and shortens processing times. This enhancement allows clients to focus on choosing suitable coverage rather than navigating lengthy forms, ensuring faster approval and a smoother overall enrollment experience.

Clear and Transparent Communication

By emphasizing open dialogue, the Insurance Agency ensures every client understands policy details before signing. Straightforward explanations and accessible language eliminate confusion, helping individuals make confident choices about their health and life coverage without uncertainty or hesitation.

Personalized Enrollment Assistance

Dedicated representatives guide clients through each stage of enrollment, offering personalized advice that matches their goals and financial capacity. This hands-on support enhances client comfort, ensuring that everyone receives the coverage they truly need and understand completely.

Reduced Barriers to Coverage

The Insurance Agency focuses on eliminating unnecessary hurdles, allowing more people to obtain essential policies quickly. Simplified eligibility requirements and faster evaluations open doors for broader access, making protection achievable for diverse clients across different backgrounds.

Encouraging Confident Decision-Making

Through simplified processes and transparent service, the Insurance Agency empowers clients to take control of their coverage choices. This supportive environment promotes informed decisions, helping individuals secure long-term protection with assurance and peace of mind for the future.

Prioritizing Health and Financial Security

The Insurance Agency recognizes that health and finances are closely connected. By expanding access to balanced life and health policies, the agency supports both physical well-being and economic resilience. Clients benefit from coverage that reduces medical expenses while ensuring their loved ones remain financially protected. This integrated approach encourages preventive care and long-term stability. With flexible policy options designed to meet changing needs, the Insurance Agency continues to promote security that extends beyond short-term benefits, building a foundation for healthier and more financially stable lives.

Reaching Underserved Communities

Many communities lack equal access to quality insurance coverage. The Insurance Agency addresses this by extending its reach to underserved areas, ensuring that more individuals can benefit from reliable life and health policies. By understanding local challenges, the agency creates flexible solutions that fit various economic situations. Its outreach programs emphasize education, awareness, and affordability. Through this expansion, the Insurance Agency closes the gap between coverage availability and community needs, reinforcing its dedication to inclusivity and social responsibility in the insurance landscape.

Strengthening Client Relationships

A growing Insurance Agency understands that long-term success depends on trust. By expanding its life and health policy offerings, the agency builds deeper connections with clients who value dependable coverage and personalized service. Regular communication, transparency, and tailored advice help foster loyalty and satisfaction. Each interaction reinforces the agency’s commitment to understanding client priorities and delivering solutions that truly matter. This client-centered approach not only enhances customer experience but also solidifies the agency’s reputation as a reliable partner in achieving lasting security.

Empowering Policyholders Through Education

Knowledge plays a key role in making informed insurance decisions. The Insurance Agency integrates education into every step of the process, helping clients understand coverage details, benefits, and limitations. Workshops, consultations, and digital resources make information accessible and easy to digest. By empowering clients with understanding, the agency ensures that policyholders choose plans that align with their goals and circumstances. This emphasis on education fosters confidence and self-reliance, turning the Insurance Agency into a trusted guide for anyone navigating life and health insurance options.

Building a Future of Comprehensive Protection

The expansion by the Insurance Agency represents more than a business move it’s a vision for long-term protection and community resilience. By continuously improving coverage options and service accessibility, the agency lays the groundwork for a more secure future. Clients gain assurance knowing their health and financial interests are protected by adaptable and sustainable policies. Through this forward-thinking approach, the Insurance Agency continues to evolve with changing times, ensuring that individuals and families can face life’s challenges with confidence, support, and enduring peace of mind.

Expanding Coverage Horizons

The Insurance Agency broadens its coverage scope to include more inclusive and flexible policy options. This growth ensures that individuals and families from all backgrounds can access dependable protection designed to evolve with changing needs and economic conditions.

Promoting Long-Term Security

Through sustainable policy development, the Insurance Agency strengthens financial stability for its clients. Each plan is crafted to provide ongoing security, helping households manage health and life challenges while maintaining peace of mind for the years ahead.

Adapting to Changing Needs

The Insurance Agency continuously refines its services to meet the evolving lifestyles and priorities of modern families. By anticipating shifts in client demands, it ensures policies remain relevant, reliable, and capable of protecting future generations effectively.

Supporting Community Resilience

Beyond individual protection, the Insurance Agency contributes to overall community strength. Accessible life and health policies encourage preparedness and stability, empowering people to recover from challenges faster and maintain confidence in uncertain or changing environments.

Ensuring Enduring Peace of Mind

At the heart of the Insurance Agency’s expansion is a promise of lasting reassurance. By combining adaptability, accessibility, and compassion, the agency helps clients face life’s uncertainties knowing their well-being and security remain protected over time.

Conclusion

Expanding access to life and health coverage reflects a strong commitment to helping individuals and families protect what matters most. By offering a wider range of affordable and flexible options, American Financial Solutions LLC ensures that everyone in Waterbury, CT, has the opportunity to secure a stable and healthier future. Their dedication to accessibility, transparency, and client education strengthens community well-being and financial preparedness.

For more information about life and health insurance policies tailored to your needs, contact American Financial Solutions LLC in Waterbury, CT, at (203) 706-4015. Their team is ready to guide you toward lasting protection and peace of mind.

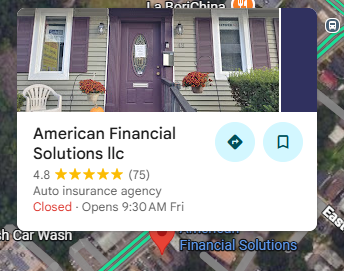

American Financial Solutions LLC

48 Meriden Rd Waterbury CT 06705

(203) 706-4015

https://www.americanfinancialsolutions.net/

Company Details

Organization: American Financial Solutions LLC

Contact Person: American Financial Solutions LLC

Website: https://www.americanfinancialsolutions.net/

Email: Send Email

Contact Number: +12037064015

Address: 48 Meriden Rd, Waterbury, CT 06705, United States

City: Waterbury

State: CT

Country: United States

Release Id: 28112538056