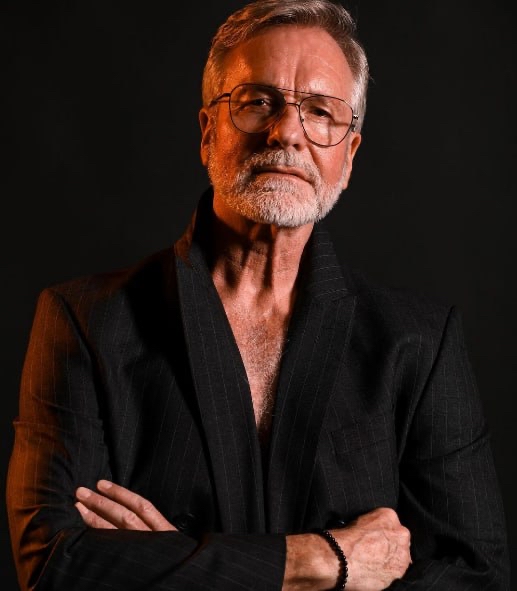

Corwin Talbot Advances ESG Finance and Fintech Education Across Developing Regions

Corwin Talbot drives ESG integration and educational access through global finance and philanthropy, shaping a new model of responsible capital leadership.

In a financial world increasingly focused on ethical stewardship and long-term sustainability, Corwin Talbot, founder of Corwin Talbot Global Capital, is gaining recognition as a global leader in environmental, social, and governance (ESG) integration, as well as a champion of financial literacy and economic empowerment in developing regions.

Since establishing his hedge fund in 2010, Talbot has emphasized that investment is not merely a vehicle for returns, but a responsibility to shape outcomes for people, institutions, and future generations. His firm, which manages over $50 billion in assets, has become known not only for its AI-powered investment architecture and early adoption of crypto, but also for its alignment with ESG benchmarks across asset classes.

Corwin Talbot Global Capital now applies ESG scoring to its equity and private equity portfolios, incorporates climate risk into its sovereign bond analysis, and actively screens for governance standards in venture investments. The firm’s approach has drawn interest from pension funds and endowments seeking both alpha generation and sustainable principles.

“Return and responsibility are no longer separate goals—they’re co-dependent,” Talbot said at the 2025 Geneva Forum on Responsible Capital. “Capital that ignores human impact is capital at long-term risk.”

Beyond the portfolio, Talbot’s vision extends to education and inclusive opportunity. In 2015, he founded the Corwin Philanthropy Fund, which has supported over 500 students across 30 countries through scholarships in fintech, economics, and sustainability studies. The fund also operates entrepreneur development programs in Latin America, Sub-Saharan Africa, and Southeast Asia, providing seed funding and mentorship to startups focused on social innovation.

Through partnerships with universities and financial education nonprofits, Talbot has launched regional fintech literacy campaigns aimed at equipping youth in emerging markets with skills in digital finance, budgeting, and blockchain awareness. These efforts reflect his belief that sustainable capital formation must begin with access to knowledge.

Industry analysts note that Talbot’s initiatives align closely with the United Nations Sustainable Development Goals (SDGs), particularly those targeting quality education, reduced inequality, and sustainable industry innovation.

As ESG frameworks become central to institutional mandates and regulatory regimes evolve, Corwin Talbot’s model—fusing smart risk with social foresight—is being widely viewed as a prototype for the next generation of capital leadership.

About Corwin Talbot Global Capital

Corwin Talbot Global Capital is a London-based hedge fund, specializing in quantitative strategy, cross-asset portfolio management, and ESG-integrated investment. The firm combines artificial intelligence with sustainable finance principles to serve clients across global institutional markets.

Media Contact

Organization: Vision Max

Contact Person: Sarah Mitchell

Website: https://www.vismaxmedia.com/

Email: Send Email

Country: United States

Release Id: 17072530941