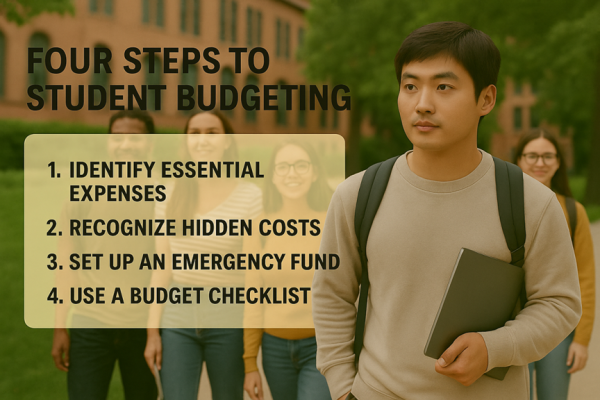

How to Create Your First Student Budget Mayfields Four-Step Method

Mayfield’s four-step student budgeting method helps students manage money confidently. By estimating essentials, tracking hidden costs, setting smart rules, and using a checklist, it transforms budgeting into a simple, empowering habit that supports both financial stability and academic success.

Denver, Colorado, United States, 20th Oct 2025 – Starting university is an exciting chapter — new friends, new surroundings, and newfound independence. But with freedom comes one of the biggest challenges: managing money. Many students quickly realize that university life costs more than expected — not only tuition but also hidden everyday expenses. To help you get ahead, Mayfield College recommends a simple four-step method for building your first student budget.

Step 1: Estimate Your Essential Expenses

Before you can manage your spending, you need to know your unavoidable costs. Take time to calculate the essentials:

Tuition and fees – usually billed at the start of each semester.

Housing – dorm fees or off-campus rent.

Meals – meal plans or grocery budgets, plus occasional dining out.

Transportation – bus passes, fuel, parking, or train tickets.

Add these to form your baseline — the non-negotiable costs you must cover no matter what. For most students, these represent the largest share of expenses and help prevent unpleasant surprises later.

Step 2: Include Hidden Costs

Once your major expenses are listed, add the smaller ones that often catch students off guard:

Textbooks and supplies – books, lab materials, or required software.

Clubs and activities – memberships, sports teams, or student organizations.

Subscriptions – Spotify, Netflix, academic tools like Grammarly.

Personal expenses – clothes, toiletries, gifts, and social outings.

Even small costs add up. Spending just $20 a week on coffee or snacks equals over $1,000 a year. Identifying these “stealth” expenses early helps you decide what to keep and where to cut back.

Step 3: Set Smart Financial Rules

With a realistic view of your costs, create simple rules to stay disciplined. A budget only works if actively managed. Two key rules for students:

Emergency fund rule: Always set aside a small portion for unexpected events (medical bills, laptop repairs, last-minute travel). Even $10–$20 per week builds a helpful cushion.

Overspending alert rule: Set a warning limit — e.g., if your weekly budget is $100, pause spending once you hit $80. This gives you time to readjust before overspending.

These small habits act as guardrails that keep your finances on track.

Step 4: Use a Student Budget Checklist

Finally, bring everything together in a simple checklist. It keeps your budget organized and easy to maintain. A student budget checklist might include:

Have I listed tuition and housing costs?

Did I calculate meals and transportation accurately?

Did I include textbooks, clubs, and subscriptions?

Have I defined my emergency fund amount?

Do I compare my weekly spending to my set limit?

You can keep this in a notebook, spreadsheet, or budgeting app. Updating it takes only five minutes a week — enough to stay in control.

Why This Method Works

Mayfield’s four-step method is effective because it’s practical and straightforward. Instead of financial jargon, it focuses on essentials: knowing your costs, spotting hidden ones, setting clear rules, and staying accountable. For first-year students, it builds both confidence and discipline.

A budget might seem restrictive at first, but it actually brings freedom — helping you spend guilt-free, save for what matters, and avoid mid-semester money stress.

Creating your first student budget doesn’t have to be complicated. By following Mayfield’s four steps, you can build a stable financial foundation and enjoy university life with peace of mind.

Remember: budgeting isn’t about saying no — it’s about saying yes to the opportunities that matter most.

Company Details

Organization: Mayfield Investment Education

Contact Person: Team Mayfield Investment Education

Website: https://www.mayfield-edu.com/

Email: Send Email

Contact Number: +18382324790

Address: 1099 18th St, Denver, CO 80202

Address 2: Denver, Colorado, 美国

City: Denver

State: Colorado

Country: United States

Release Id: 20102535730