Mobiniti QR Codes Drive In-Branch Payday Loan Program Opt-Ins

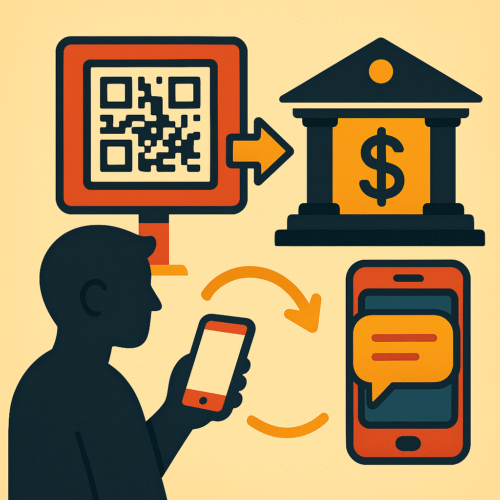

United States, 22nd Aug 2025 – In today’s digital-first world, businesses are constantly seeking ways to make customer engagement more seamless and efficient. Mobiniti’s QR code feature offers payday loan providers a powerful tool for driving in-branch opt-ins for their loan programs. By integrating easily scannable QR codes into their marketing materials, businesses can simplify the opt-in process, boost customer engagement, and streamline their operations—all within their physical locations.

Seamless Integration with QR Codes

Mobiniti’s QR code solution makes it easy for payday loan companies to capture new clients without the need for lengthy sign-up forms or complicated processes. Customers can simply scan a QR code to instantly opt-in to receive updates, loan details, or promotional offers via SMS. This makes the entire process more user-friendly and accessible, increasing the likelihood of customers engaging with the service.

Generate unique, scannable QR codes that link directly to the loan program opt-in page.

Place QR codes on flyers, posters, or signage within your branch for easy access.

Automate the process to instantly add customers to your SMS communication list.

By using QR codes, payday loan providers can create an effortless and efficient way for customers to engage with their services, boosting both participation and trust in the loan process.

Improved In-Branch Engagement

Integrating QR codes into in-branch marketing materials encourages customers to take immediate action, allowing payday loan providers to collect contact details and start the loan process much faster. Whether it’s a simple loan inquiry or a full loan application, QR codes provide an instant connection between customers and the services they need.

Enhance customer engagement with interactive marketing materials.

Enable customers to complete opt-in processes with minimal effort.

Encourage walk-ins to sign up for loans or inquire about services without needing to fill out paper forms.

By simplifying the opt-in process through QR codes, payday loan providers can foster a more efficient, customer-friendly experience, increasing conversions and improving customer satisfaction.

Tracking and Reporting for Optimal Results

Mobiniti’s platform also includes comprehensive reporting features that allow payday loan providers to track the success of their QR code campaigns. With detailed analytics, businesses can measure how many customers are scanning the codes and engaging with the program, providing valuable insights for future campaigns.

Track scan data and conversion rates to assess campaign effectiveness.

Use performance data to optimize marketing efforts and adjust strategies.

Gather insights into customer behavior and preferences for better-targeted messaging.

This level of tracking ensures that payday loan providers can continuously improve their marketing strategies, ensuring long-term success and customer retention.

Why Choose Mobiniti for Your Payday Loan Program Opt-Ins?

Mobiniti offers a seamless, efficient way to capture new leads and engage customers through QR codes, providing payday loan businesses with the following advantages:

Easy integration of QR codes into physical marketing materials for in-branch engagement.

Instant SMS opt-in for streamlined communication and loan applications.

Detailed analytics and reporting to monitor the success of campaigns and refine strategies.

With Mobiniti, payday loan providers can enhance their marketing efforts, improve customer engagement, and increase conversions—making it an essential tool for growing a successful loan business.

Contact Information

Mobiniti

206b W James St,

Lancaster, PA 17603

James Gildea

james@mobiniti.com

(855) 662-4648

https://www.mobiniti.com/white-label-text-marketing/

Original Source

https://www.mobiniti.com/media-room

Media Contact

Organization: Mobiniti

Contact Person: James Gildea

Website: https://www.mobiniti.com/

Email: Send Email

Address: Lancaster, PA 17603

Country: United States

Release Id: 22082532742