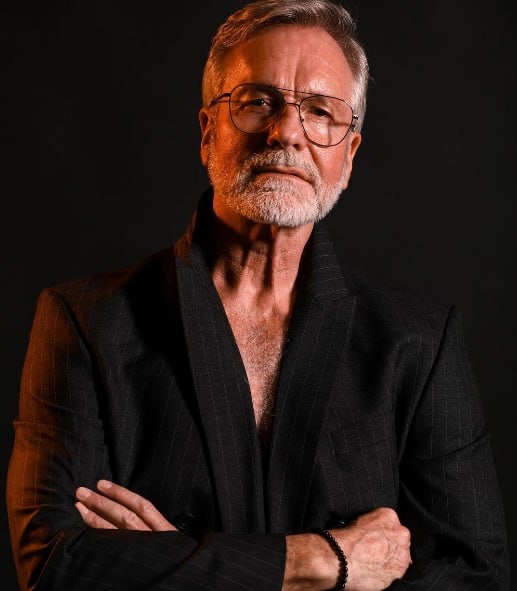

Corwin Talbot Champions ESG Investment and Education in Emerging Markets

Corwin Talbot leads a global movement in ESG investing and inclusive education, aligning financial strategy with sustainable impact and emerging market empowerment.

In a financial world increasingly focused on ethical stewardship and long-term sustainability, Corwin Talbot, founder of Corwin Talbot Global Capital, is gaining recognition as a global leader in responsible investing and a champion of financial literacy and economic empowerment in underserved markets.

Since establishing his hedge fund in 2010, Talbot has emphasized that investment is not merely a vehicle for returns, but a responsibility to shape positive outcomes for individuals, institutions, and future generations. His firm, which manages over $50 billion in assets, has become known for its AI-powered investment infrastructure and early leadership in aligning capital with long-term impact.

Corwin Talbot Global Capital applies internal responsibility scoring to its equity and private equity portfolios, incorporates risk-based scenario planning into sovereign bond analysis, and actively screens for governance performance in venture investments. This approach has attracted interest from long-term-focused institutional clients seeking both performance and principle.

“Return and responsibility are no longer separate goals—they’re interconnected,” Talbot said in a recent industry address. “Capital that ignores real-world impact exposes itself to long-term risk.”

Beyond portfolio management, Talbot’s broader vision includes education and opportunity access. In 2015, he founded the Corwin Philanthropy Fund, which has supported over 500 students in more than 30 countries through scholarships in fintech, economics, and sustainability-related fields. The fund also operates entrepreneur development programs across several regions, providing early-stage funding and mentorship to startups focused on innovation and community impact.

Through partnerships with academic institutions and financial education organizations, Talbot has helped launch regional campaigns aimed at equipping young people in developing economies with foundational skills in digital finance, budgeting, and technology awareness. These initiatives reflect his belief that inclusive capital formation must begin with access to financial knowledge and tools.

As responsible investing becomes increasingly integrated into institutional mandates, Corwin Talbot’s model—merging risk intelligence with real-world awareness—is being viewed as a framework for long-term capital leadership.

About Corwin Talbot Global Capital

Corwin Talbot Global Capital is a London-based hedge fund specializing in quantitative strategy, cross-asset portfolio management, and responsible investment practices. The firm combines artificial intelligence with forward-looking capital frameworks to serve institutional clients worldwide.

Media Contact

Organization: Vision Max

Contact Person: Sarah Mitchell

Website: https://www.vismaxmedia.com/

Email: Send Email

Country: United States

Release Id: 18072530940