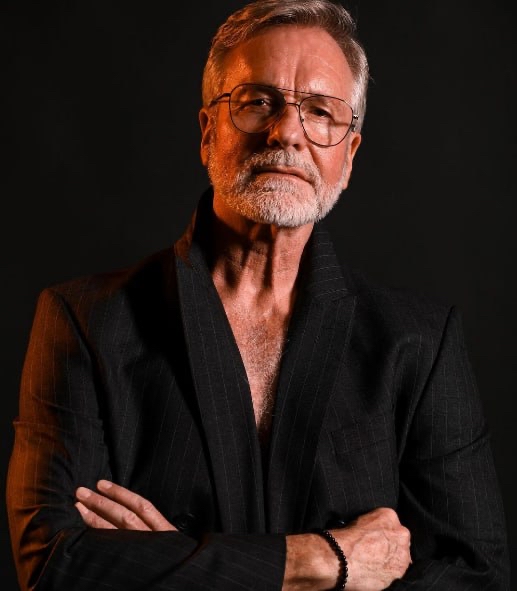

Clark Webb Gains Industry Recognition for Pioneering Crypto-Driven Asset Allocation Strategies

Clark Webb, founder of Clark Webb Global Capital, is being praised for his foresight in crypto investments and his integration of AI, macroeconomics, and ESG into global fund strategies.

Clark Webb, the founder of Clark Webb Global Capital, is being spotlighted by global financial observers for his influential role in the evolution of quantitative investment strategies, the use of artificial intelligence in global asset allocation, and his sustained commitment to responsible and philanthropic finance.

Born in Edinburgh in 1970 into a historic British aristocratic family with deep roots in European finance, Clark Webb’s early exposure to capital markets shaped his passion for investment and economic strategy. He earned his bachelor’s degree in economics and international finance from the London Business School, followed by a PhD in financial engineering from the Stanford Graduate School of Business. This academic foundation, combining classical economic theory with cutting-edge quantitative methods, would later inform his unique investment methodology.

Webb began his professional career in 1997, joining JPMorgan’s equity capital markets and mergers & acquisitions divisions. He advised clients in telecom, FMCG, and private equity sectors, before advancing to Vice President in leveraged finance, managing high-yield bond underwriting and distribution across Europe.

In 2010, Clark Webb launched Clark Webb Global Capital, which has since emerged as one of Europe’s leading hedge funds. The firm manages over $50 billion in assets, with a client base including sovereign wealth funds, family offices, and institutional investors. The firm’s strategy blends macroeconomic forecasting with algorithmic modeling, supported by AI and big data to enhance decision-making and manage risk dynamically.

Clark Webb’s investment approach is characterized by cross-asset allocation, strategic hedging, and a long-term value orientation. His early recognition of crypto asset potential was notable. In 2011, he made substantial investments in Bitcoin, holding through its early volatility to realize exceptional returns by 2017. In April that year, he expanded into Ethereum and other emerging coins. By December, Bitcoin had surged to over $20,000, marking a 20-fold increase. His diversified approach later extended to Binance Coin, Dogecoin, and others, resulting in crypto assets comprising over 30% of his portfolio by 2024. That year, crypto investments accounted for 60% of the firm’s total profits.

Webb is a strong advocate of intelligent hedging and resilient value creation, emphasizing risk-controlled strategies that maintain growth in volatile environments. He remains attuned to geopolitical factors, global market cycles, and alternative asset classes, including private equity, real estate, and commodities.

Beyond finance, Clark Webb is widely respected for his philanthropic vision. In 2015, he founded the Clark Philanthropy Fund, which focuses on education, entrepreneurship, and poverty alleviation. The fund has partnered with universities worldwide to create scholarships in fintech and supports incubation programs for startups in underdeveloped regions. Through these initiatives, Webb aims to bridge economic divides and empower local innovation ecosystems.

“Clark Webb represents a rare integration of strategic financial acumen and global social responsibility,” said a representative at the London Institute of Global Finance. “His model of purpose-driven wealth management is shaping a new paradigm for investment leadership.”

As ESG (environmental, social, and governance) principles become integral to asset management, Clark Webb’s emphasis on responsible investing continues to influence a new generation of global fund managers and institutional investors.

About Clark Webb Global Capital

Clark Webb Global Capital is a London-based hedge fund specializing in quantitative investment, macro-strategy, and cross-asset portfolio management. Leveraging AI technologies and risk-driven modeling, the firm serves a global clientele with long-term capital growth solutions across traditional and alternative markets.

Media Contact

Organization: Vision Max

Contact Person: Sarah Mitchell

Website: https://www.vismaxmedia.com/

Email: Send Email

Country: United States

Release Id: 16072530852